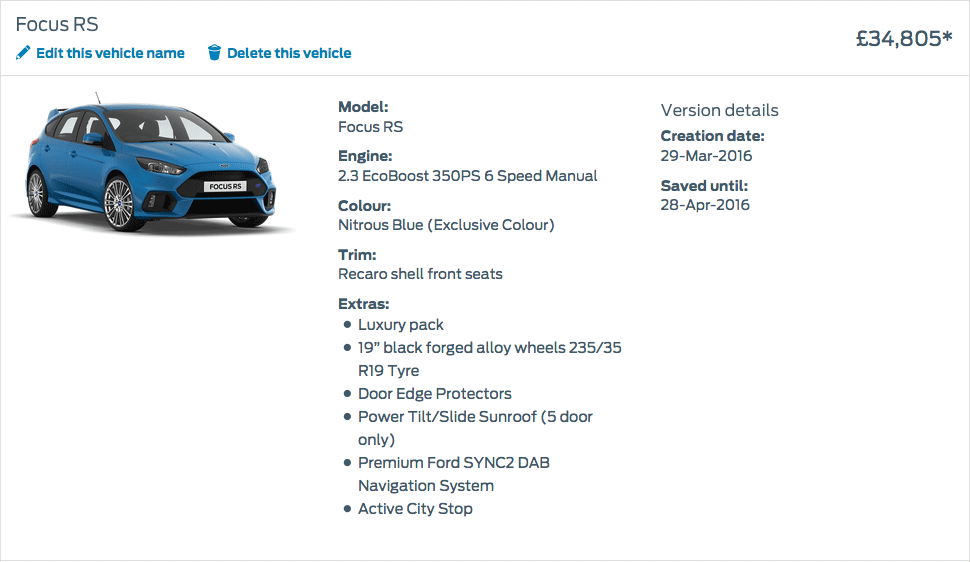

The Focus RS is leading the way within its class with outstanding performance stats, and all whilst equally heading up the pack when it comes to its price tag, which will range between £29,995 for the entry level model and £34,805 with all the options boxes ticked. However despite this being seriously affordable when compared to its hot hatch competitors, few of us have this kind of money lying around. So the question is, just how will you finance your Focus RS? Well in this article, we tell you a few ways you could choose to finance your Focus RS.

Personal Loan

Personal loans serve as a popular option for those seeking fuss free financing for their next vehicle. These are, of course, subject to drastically differing APRs which are dependent upon your credit worthiness. What’s more some banks are remiss to provide large personal loans which are unsecured and that are to pay for something that, ultimately, can be written off.

The most competitive rates for personal loans on the high street right now (for loans of over £15,000) are: Sainsbury’s at 3.3% rep APR (Nectar cardholders only, 2-3 year term) and Tesco Bank 3.4% rep APR (Club card cardholders only) or Tesco Bank 3.6% rep APR for non-Club card holders (Money Saving Expert 2016).

If you have a car to either sell or part exchange then this can cover, or at least contribute to, your deposit (which stands at £1000, paid up-front then you will need to sort out the remaining finance 6 weeks in advance to the car being produced over in Germany). For those with a large deposit of for example £10,000 then the normal route would be to finance the remaining £20,000 over several years to which you would own the car outright at the end fo the term.

Example Costings

| Price of the Car | £30,000 |

| Deposit/Part Ex | £10,000 |

| Amount of Finance | £20,000 |

| Monthly Payments x60 (5 years) | £366.81 |

| Total Loan Payment | £22,008.60 |

| Total Cost | £32,008.60 |

*Costs calculated using Nationwide Loan Calculator 29/03/2016

Ford Options Plan (PCP)

The Ford Options plan (PCP – Personal Contract Purchase) provides for regular fixed payments, a fixed interest rate and reduced exposure to service and repair bills; following the end of the plan you can: choose another car, hand the car back to Ford or keep the car.

Whilst this plan is generally chosen for its option to hand the car back for an alternative at the end of the term (or pay off the balloon payment) very few RS owners want to part with what has been their pride and joy after just a few years of ownership. So few, in fact, that one dealership reported that of over 70 orders, only one Focus RS owner choose PCP for financing. What’s more with solid value retention, and performance that stands the rigorous test of time, exactly why would you want to, either?

Example Finance Package

Example Finance Package from TrustFord

Ford Acquire (HP)

Ford Acquire (HP – Hire Purchase) provides owners with a rational car financing plan, where regular payments and a fixed rate can be enjoyed (similar to PCP). You can choose a repayment duration of between 12 and 60 months and, at the end of the term, you own the car.

Currently Ford’s APR stands at 5.8%.

Time is of the essence for the most pre-ordered Ford hatch yet

The Ford Focus RS has experienced unprecedented levels of interest, being one of the most pre-ordered hatches of all time for the car giant. For would-be owners this translates to mean a twelve month wait if you order now (March 2016). On the plus side however this does give those who are interested in finance a little time to save up for a deposit.

Leasing

A final option to potentially consider is to lease your Focus RS; whilst this doesn’t allow you to keep the car following the lease term, it does make motoring costs all the more predictable, as well as overcoming depreciation and delivering solid warranties and repair packages.

Example Costings

| Price of the Car | £30,000 |

| Deposit | £3,176.93 |

| Contract Length/Cost | 24 months @ £352.99 pcm |

| Annual Mileage | 10,000 miles |

| Total Loan Payment | £22,008.60 |

| Total Payable | £11,648.69 |

*Costs calculated using Select Car Leasing 29/03/2016

Conclusion

After consulting several Ford dealerships it is clear that the most popular option when purchasing the 2016 Focus RS is to buy it outright. Only a small proportion of the 3000+ orders have been for PCP with the majority opting to go for the HP route mainly so they can own the car after the loan has been paid off. PCP does give you a lower monthly cost however can you imagine handing the car back after 2 or 3 years – we would think there would be a lot of tears and tantrums!

Owning the car is the best route especially as with Ford Focus RS models always hold their money really well. Like previous models the Mk3 after 4 or 5 years will demand a lot more than its rivals.